Each day, another omen of economic doom appears in the headlines: whether it’s rising interest rates, recession indicators, supply chain snafus, or inflation, the data is dizzying enough to make folks scratch their heads in bewilderment as to their own financial health.

While we won’t hazard a guess as to the price of a dozen eggs this spring, we’re happy to decode the data to predict the performance of the Richmond Real Estate Market in 2023. Let’s start with the national trends.

Mortgage Interest Rates

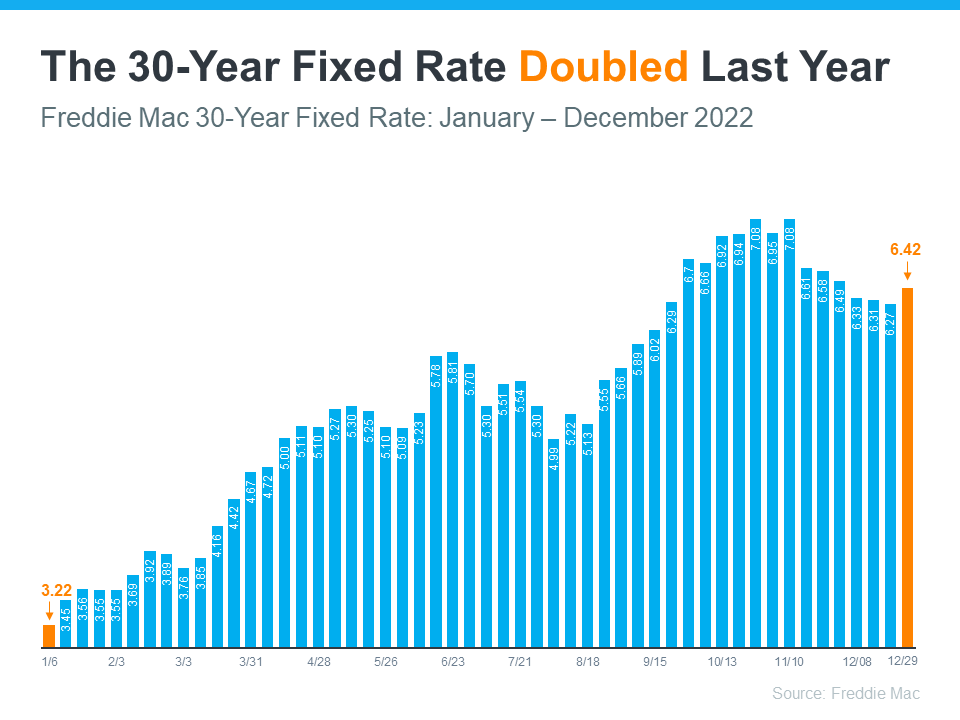

As illustrated in the graphic below, mortgage interest rates doubled in 2022, which stabilized home prices. The rapid spike in interest rates jolted many potential buyers into a state of analysis paralysis—constantly crunching the numbers on buying now versus waiting for a rapid rate decrease that might not come to fruition.

While we might have just experienced the most substantial year-to-date rate increase in over fifty years, it’s also important to keep things in perspective: the current sub-6.5% interest rates, while glaringly higher than this time last year, are still a far cry from those pushing 20% four decades ago.

Although there’s just no getting around the fact that the rapidly rising interest rates have given some buyers pause (with others finding themselves priced out of the market altogether), take heart: forecasting experts at Freddie Mac and other entities are predicting rates to settle down to around 6.2% by the end of this year.

The good news is that mortgage rates are in the low 6’s at the time of this writing in January, so we have started to experience some relief. At The Beran Group we have already seen buyers get back into the market in the first couple weeks of January. Buyers are growing accustomed to the new mortgage rate normal.

Market Rents

As you can see in the forecast below, the cost of renting versus buying is expected to rise another 6.3% in 2023. These increases can be attributed to a combination of inflation, construction and maintenance costs, as well as supply and demand.

We often see social media posts reminding renters that they’re already paying a mortgage…just not their own, along with the cutesy advice to ”marry the house, but date the rate.” While the delivery might be a bit cheesy, the underlying message is pretty solid. Economist Odeta Kushi puts it much more eloquently: “If you can find a house that meets your financial expectations for a monthly payment and it’s a good time for you to buy, then do that. If you wait for prices to fall but they never do, you may discover the hard way that the house you found a year ago that you really loved and passed on is more expensive next year.”

Are We Headed Towards a Recession? How Might Pricing be Impacted?

Carrying slightly more weight than a mere downturn, a recession has traditionally been defined as an economic contraction during which trade and industrial activity are reduced, generally identified by a fall in Gross Domestic Product for two consecutive quarters. While many experts agree that we are not currently in the midst of a recession, the jury’s out on whether that will remain the case by year’s end. In fact, the Wall Street Journal polled economists as to their confidence that a recession would occur within the next 12 months: in January 2022, only 18% of economists predicted an upcoming recession; by October, that total was up to 63%.

The odds are good that a recession might be on the horizon, which means that housing prices are definitely going to fall off a cliff, right? Not so fast:

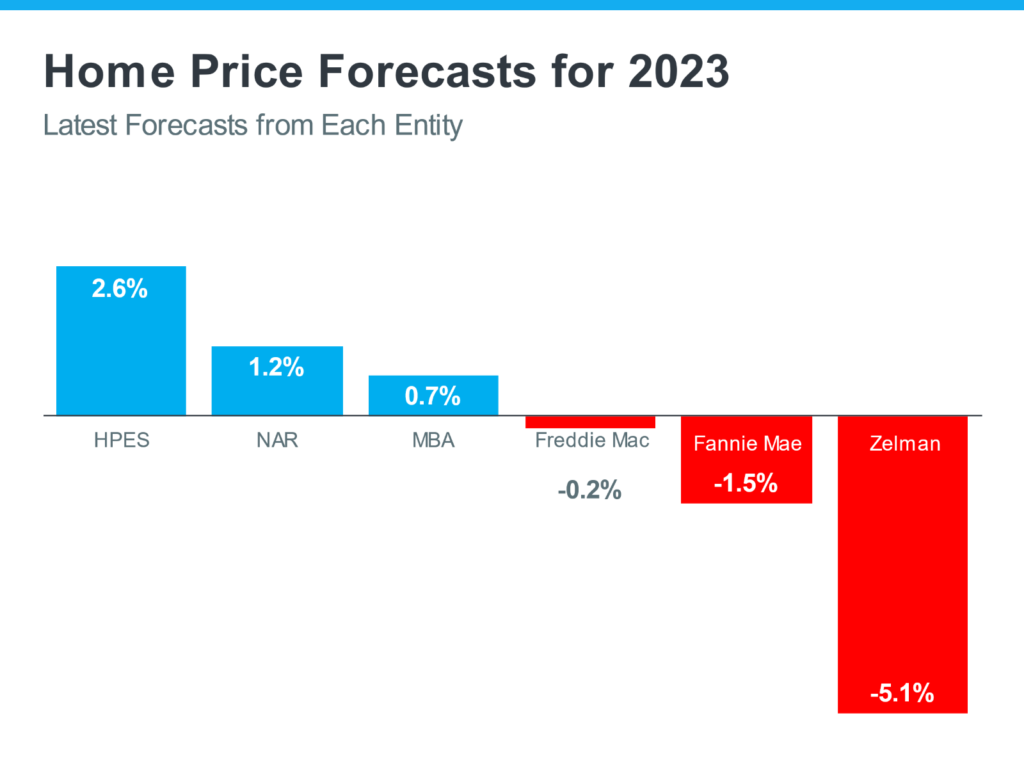

As we can see from the data above, home prices actually increased during four of the last six recession cycles. Only time will tell how that data will translate to our current situation—many economic institutions are predicting a modest decrease in home prices throughout 2023, with a return to a more normal price appreciation in 2024:

Note that Freddie Mac is hedging their bets for their 2023 home price forecast, simply stating: ”while there may be a little statistical difference between a small positive number and a small negative number—so talking about some appreciation, some depreciation—there are often huge differences in how they impact behavior.”

The Richmond Market

So what about Richmond?

Historically, the Richmond area has enjoyed more stability than our larger urban counterparts, experiencing more muted upswings and downswings in values. Richmond housing receives less outside investment than larger metropolitan areas such as San Francisco or Phoenix, which helps temper market conditions.

We are also buoyed by the fact that Richmond continues to be an increasingly attractive place to live and work remotely in the post-COVID era, with its temperate climate and variety of all-season activities. In fact, while many major markets lost 1-2% of their population, Richmond grew .6% between 2020-2021, making us the 16th fastest growing large metro area nationally. Relocation interest from cities like Washington D.C. and even New York continues to benefit Richmond’s population growth, as workers are able to relocate to areas of their choosing.

An increase in population naturally leads to greater housing demand, and we’re seeing that demand reflected in pricing. Through December 2022, home prices were only down 6.8% from their peak in June. Historically both sales units and volume tend to decrease slightly from summer to winter in our region—even during the fastest-paced markets of 2020 and 2021. Note that Richmond prices are still up almost 8% versus the end of 2021, whereas this is simply not true in some larger markets nationally.

We expect unit sales to be down slightly from the blistering pace of 2022, but not significantly. If you’re waiting for a major price decline to buy a house or make a move, don’t. We expect prices will start to climb again in Richmond as Spring market hits in March/April. Low inventory remains, and we have already seen multiple offers on homes in January.

The Bottom Line

If you’re a potential buyer in this market, don’t be discouraged–while it’s easy to get caught up in the panic of higher interest rates, you might also face less competition in the buyer pool.

If you’re thinking of selling this year, odds are you’ll have very little competition to contend with. While the current market might look a little more like 2019, don’t expect a full shift towards a buyers’ market anytime soon—the historic lack of inventory still puts the ball firmly in the seller’s court.

Whether your 2023 plans include buying or selling (or both!), we would love to help you meet your real estate goals—contact your favorite Beran Group agent today to get started!

Kristin is the founder and owner of The Beran Group, a real estate team of over 20 agents and the #1 team at Shaheen, Ruth, Martin & Fonville in Richmond, VA. Her 18-year career in real estate has resulted in over 1,200 transactions with a total of more than $310 million in residential sales.

Kristin was born and raised in RVA. Throughout her career, she has impacted Richmond by serving in industry leadership roles at the national, state, and local levels. She holds a B.S. in Mass Communications from Virginia Commonwealth University and has achieved numerous industry awards including Rookie of the Year, and is certified by the Institute for Luxury Home Marketing.

Kristin currently helps her clients buy and sell homes throughout the Greater Metro Richmond area, and works with Realtors to grow themselves and their businesses to achieve new heights.

In her free time, Kristin can be found on her farm with her family and horse, reading, listening to podcasts, or taking tennis and pilates classes. She enjoys watching her son Anders play squash, tennis, and golf with Bryan, her husband of nearly 20 years.

Mair Downing is the editor at BeranGroupHomes.com. She oversees the development and creation of all of our articles, so if you like them, be sure to let her know!

Mair is also an amazing Realtor with The Beran Group. She’s never met a stranger, so it’s no surprise if you feel like old friends after the first meeting. Mair is passionate about helping sellers and buyers navigate the sometimes complex world of real estate. She is experienced in helping clients buy, sell, invest and rehab-to-sell. Mair is a born problem solver and relationship builder, which helps to make transactions go smoothly!